Sluggish tempo of business exercise, particularly in manufacturing, mining and electrical energy sectors, and tepid consumption development, primarily in city areas, is more likely to have resulted in a slower financial development charge within the July-September quarter.

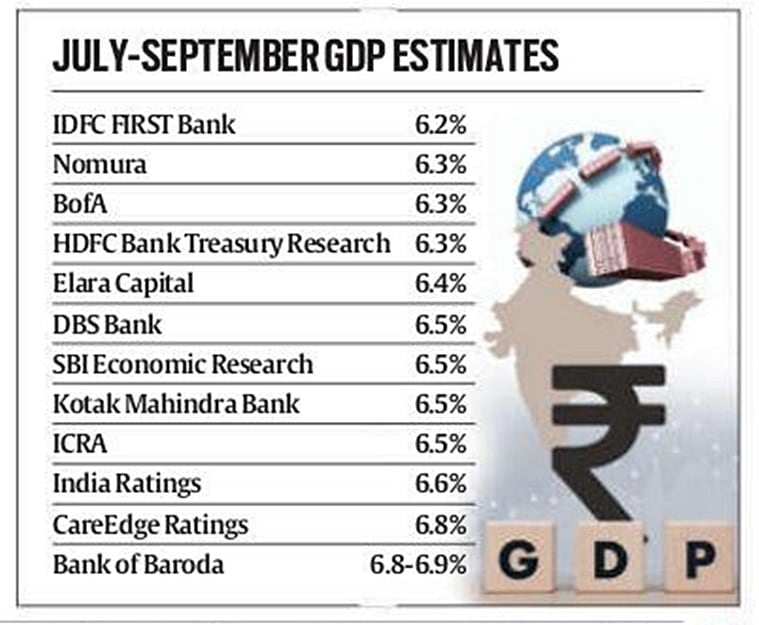

Actual Gross Home Product (GDP) development in Q2, for which information will likely be launched right now, is seen slowing to a six-quarter low of 6.5 per cent from 6.7 per cent in April-June and eight.1 per cent a 12 months in the past, as per the median of estimates by 12 economists.

Whereas capital expenditure noticed a pickup in Q2 after the mannequin code of conduct-induced hunch throughout the Lok Sabha elections earlier, it has remained beneath the year-ago ranges for each states and Centre, including to the expansion slowdown considerations. Amongst all sectors, agricultural development is being seen as the brilliant spot with good kharif output estimates and a restoration in rural demand.

“We anticipate agriculture GDP to rise to a 6-quarter excessive of 6.0 per cent, given elevated kharif meals manufacturing estimates. Nevertheless, the most important lack of momentum is seen within the industrial sector, with mining, electrical energy & fuel slowing significantly, whereas manufacturing GDP development might broadly transfer sideways to register 6.0 per cent YoY development, according to IIP information. Development development is more likely to climb down to six.0 per cent from the elevated 10.5 per cent YoY development in Q2 24, as metal output development declined, whereas cement grew barely.

Providers development is more likely to lose some momentum largely attributable to a pullback in credit score development, which has slowed down significantly in current months,” Rahul Bajoria, India & ASEAN economist, Financial institution of America stated.

The GDP information for July-September is scheduled to be launched by the Nationwide Statistical Workplace (NSO) right now at 1600 IST. The GDP development estimates vary between 6.2 to six.9 per cent for July-September.

A sharper moderation in exports than imports can also be seen weighing on Q2 development, with the drag estimated to be of about 1.1 share factors as in comparison with contribution of 0.7 share level in Q1, Sonal Varma, Nomura’s chief economist for India and Asia ex-Japan stated, including that general, India is seen to have entered a “cyclical development slowdown”.

“On the availability aspect, we anticipate GVA development to average to six.3 per cent YoY in Q2 from 6.8 per cent in Q1, with development easing within the industrial and building sectors. On the optimistic aspect, we anticipate agricultural development to select up, “monetary, actual property {and professional} providers” development to stay sturdy, and we’re constructing in a restoration within the erstwhile lagging “commerce, lodges, transport and communication” sector. Total, we imagine India has entered a cyclical development slowdown, and we see rising draw back dangers to our baseline GDP projections of 6.7 per cent YoY in FY25 and 6.8 per cent in FY26,” Varma stated.

The Reserve Financial institution of India (RBI) has projected GDP development charge for FY25 at 7.2 per cent and seven.1 per cent for FY26. Final week, Financial Affairs Secretary Ajay Seth had stated there may be “no vital draw back danger” to the 6.5-7 per cent development projection for the continuing monetary 12 months 2024-25, as detailed within the Financial Survey, regardless of a probable slowdown within the September quarter.

Development prospects going forward

Whereas one of many greatest considerations is concerning the gradual tempo of capex by each states and Centre, a pickup in rural demand and agricultural development is seen supporting development going forward. Capex is anticipated to undershoot the goal of Rs 11.11 lakh crore for FY25 with tough estimates displaying that Centre’s capex may turn into round Rs 55,555 crore lower than the goal. The second half poses a problem for the Centre because it should step up its capex by 52 per cent in H2 to attain the FY25 funds goal of Rs 11.11 lakh crore. Equally, states require an over 40 per cent growth in capex throughout the second half to satisfy their funds targets.

Nevertheless, financial indicators for October already level to a optimistic shift in general exercise, with notable enhancements throughout a number of sectors together with manufacturing and providers Buying Managers’ Indices (PMI), GST collections, e-way invoice volumes, and toll revenues, HDFC Financial institution’s Treasury Analysis stated in a observe. The demand-side dynamics present that rural demand is now starting to outpace city demand, it stated. “We’ve seen a pointy uptick in providers and agriculture. This augurs nicely for development. There was a 7-8 per cent development in company earnings and aside from oil, fuel and metal, different sectors have carried out higher. There was a pickup in consumption as could be seen from GST (Items and Providers Tax) figures and vehicle gross sales. Inflation can also be anticipated to maneuver downwards December onwards. We see FY25 GDP development at 7.3-7.4 per cent,” Madan Sabnavis, chief economist, Financial institution of Baroda stated.

Rabi sowing can also be anticipated to do nicely and the potential for development momentum is optimistic for H2 with a restoration in authorities spending, Rajani Sinha, chief economist, CareEdge Rankings stated. “This restoration is anticipated to help each capex and personal consumption demand. Rabi sowing is anticipated to do nicely as reservoir ranges stay snug in most areas. A very good kharif crop, together with a brighter prospect of rabi sowing, augurs nicely for rural demand situations,” Sinha stated.